Overview of the Current Crypto Market Crisis

The cryptocurrency market is currently experiencing a significant downturn, with Bitcoin plunging to approximately $93,000 and Dogecoin witnessing a staggering 27% drop. This bloodbath in the crypto space has been attributed to a variety of factors, including macroeconomic influences, market sentiment, and technical indicators. This article delves into the reasons behind this drastic decline, the implications for investors, and the broader impact on the cryptocurrency ecosystem.

Bitcoin’s Recent Performance

Bitcoin, the leading cryptocurrency by market capitalization, has faced intense volatility in recent weeks. After reaching an all-time high of over $108,000 earlier this month, Bitcoin’s price has dramatically retraced due to a combination of external pressures and internal market dynamics. As of December 21, 2024, Bitcoin was trading at around $97,360, reflecting a significant drop from its peak.

Factors Contributing to Bitcoin’s Decline

Macroeconomic Influences:

- The Federal Reserve’s recent announcements regarding interest rates have had a profound effect on risk assets, including cryptocurrencies. Fed Chair Jerome Powell’s comments about potentially prolonged high-interest rates have rattled investor confidence and contributed to a wave of sell-offs across the market.

- The broader economic landscape remains uncertain, with inflation concerns leading investors to reassess their positions in speculative assets like Bitcoin. This has resulted in increased volatility and panic selling within the crypto market.

Market Sentiment:

- The sentiment among investors has turned bearish as trading volumes surged amid panic selling. Over $1.2 billion in crypto positions were liquidated within a single day, with Bitcoin accounting for a substantial portion of these liquidations.

- Technical indicators also suggest that Bitcoin is currently in an oversold condition, with the Relative Strength Index (RSI) dipping below 35. This indicates potential bearish momentum and further selling pressure in the short term.

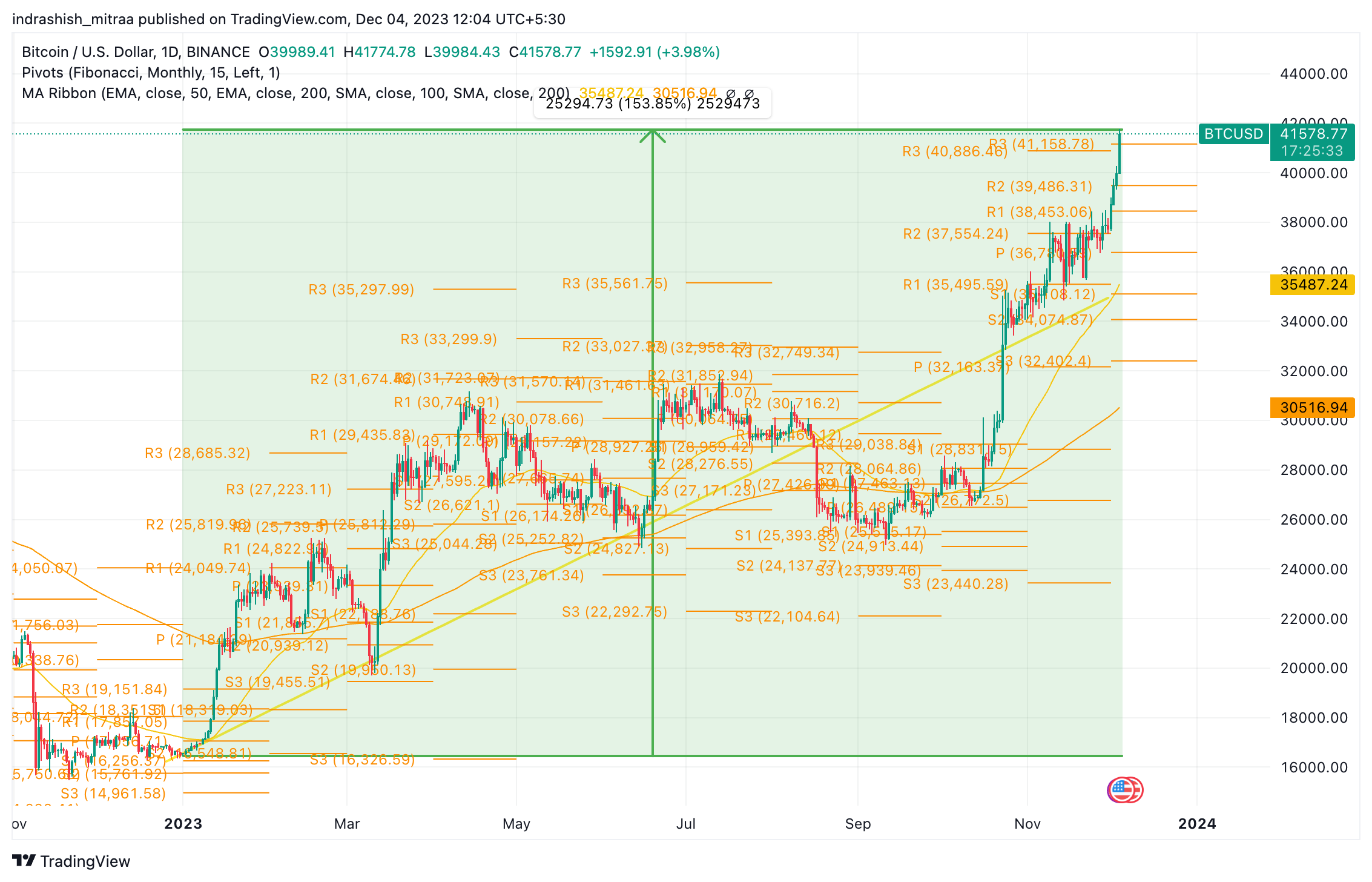

Technical Analysis:

- Bitcoin has breached several key support levels, including the 20-day and 50-day moving averages. This breach signals weaker buying momentum and heightens the likelihood of continued downward pressure on its price.

- Analysts are closely monitoring critical support levels at around $94,400 and $90,000. A drop below these levels could trigger further declines and increase bearish sentiment among traders.

Dogecoin’s Plunge

Alongside Bitcoin’s decline, Dogecoin has also faced significant losses, dropping approximately 27% during this turbulent period. This decline highlights the interconnectedness of the cryptocurrency market, where movements in major assets like Bitcoin often influence altcoins.

Reasons for Dogecoin’s Decline

Market Correlation:

- Dogecoin’s price is heavily influenced by Bitcoin’s performance. As Bitcoin experiences volatility and declines, altcoins like Dogecoin often follow suit due to investor sentiment shifting towards safer assets.

Speculative Nature:

- Dogecoin is known for its speculative trading nature, which makes it particularly sensitive to market trends. The recent downturn has led many investors to exit their positions in favor of more stable investments.

Social Media Influence:

- The price movements of meme coins like Dogecoin are often driven by social media trends and celebrity endorsements. A lack of positive sentiment or news can lead to rapid sell-offs when market conditions are unfavorable.

Broader Market Implications

The current downturn in Bitcoin and Dogecoin is symptomatic of larger issues within the cryptocurrency market. The interconnectedness of various digital assets means that declines in major cryptocurrencies can trigger widespread sell-offs across the board.

Impact on Other Cryptocurrencies

- Ethereum: The second-largest cryptocurrency by market cap has also suffered losses, dropping nearly 12% during this period as investors reacted to Bitcoin’s decline.

- XRP and Solana: These altcoins have experienced similar downturns, with XRP falling by 11% and Solana dropping below $200.

- Other Altcoins: Many altcoins have followed suit; Cardano saw a 15.7% decline while Shiba Inu recorded a significant 23.3% drop.

Investor Behavior

The current market conditions have led many investors to adopt a cautious approach:

- Increased Liquidations: With heightened volatility comes increased liquidations as traders attempt to cut losses.

- Shift Towards Stability: Investors may begin shifting their portfolios towards more stable assets or fiat currencies as they seek to mitigate risk during uncertain times.

Future Outlook

While the current situation appears grim for cryptocurrencies like Bitcoin and Dogecoin, analysts maintain a cautious optimism regarding their long-term potential.

Potential Recovery Signals

- Historical Resilience: Cryptocurrencies have historically shown resilience following downturns; many analysts believe that this could be another opportunity for recovery.

- Institutional Interest: Despite current volatility, institutional interest in cryptocurrencies remains strong, which could provide support for future price increases as regulatory clarity improves].

- Long-Term Predictions: Some analysts continue to predict bullish long-term targets for Bitcoin, suggesting that prices could reach upwards of $180,000 by early 2025 based on factors such as institutional adoption and regulatory clarity].

Key Support Levels to Watch

Investors should monitor critical support levels closely:

- $94,400–$94,300: This range represents key Fibonacci retracement levels that could act as support.

- $90,000: Another psychological level that could influence trader behavior if breached.

- $72,328: A significant Fibonacci retracement level that aligns with previous highs from earlier in the year.

Conclusion

The recent plunge in Bitcoin’s price to around $93K and Dogecoin’s sharp decline reflects broader trends within the cryptocurrency market influenced by macroeconomic factors and investor sentiment. While short-term prospects appear challenging amid heightened volatility and liquidation events, historical patterns suggest potential recovery paths ahead.

Investors should remain vigilant as they navigate these turbulent waters while keeping an eye on key technical indicators and macroeconomic developments that could shape future price movements in this dynamic landscape.